To help you choose the best option, we’ve reviewed the top business tax filing software for 2025 based on cost, ease of use, features, and expert support.

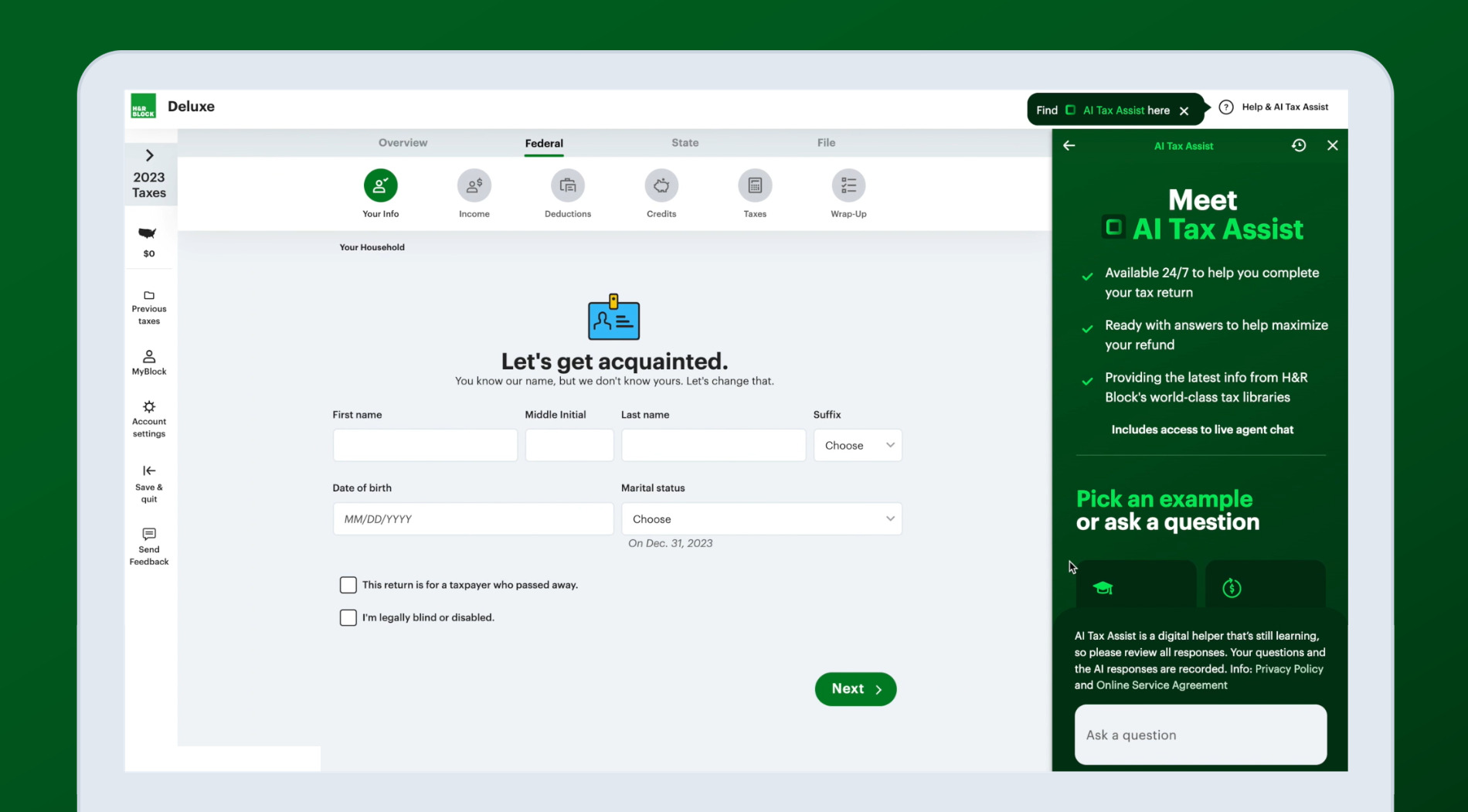

H&R Block Self-Employed Online

H&R Block offers a comprehensive tax filing solution for businesses of all sizes. With its guided tax preparation process, AI-powered tax assistance, and access to live experts, it’s a well-rounded option.

Key Features:

- AI Tax Assist and live expert guidance available

- Audit and tax notice support (for an additional fee)

- Mobile app for easy access

- Ability to file multiple business types, including sole proprietorships and LLCs

Pros:

- Easy-to-follow tax prep process

- Expert support available for complex filings

- Offers audit assistance

Cons:

- More expensive than some competitors

- Professional tax help requires an additional fee

H&R Block is a great choice for business owners who want a reliable and feature-rich tax filing experience.

TurboTax Premium

TurboTax Premium makes tax filing easier by offering automatic data imports and industry-specific deduction suggestions. It’s a top pick for those who want audit support at no extra charge.

Key Features:

- Automatically imports W-2 and 1099 forms

- Industry-specific deduction suggestions

- Free audit support

- Mobile app for on-the-go filing

Pros:

- Streamlined filing process

- Provides industry-specific tax tips

- Includes free audit support

Cons:

- More expensive than some competitors

- Live assistance is only available in certain states

- C-Corp tax filing support is limited

TurboTax Premium is ideal for businesses that want a user-friendly platform with built-in audit protection.

TaxAct Self-Employed

If you need to file both business and personal taxes, TaxAct Self-Employed offers bundled options to help you save money.

Key Features:

- Ability to import previous tax returns

- Guided tax preparation

- Bundle options for business and personal returns

- Live assistance available as an add-on

Pros:

- Helps simplify both business and personal tax filing

- Easy import of past tax data

- Affordable compared to some competitors

Cons:

- Audit support is limited

- Not all state tax forms are supported

- Free customer service does not include tax advice

TaxAct is a great choice if you want an affordable, all-in-one solution for filing both personal and business taxes.

TaxSlayer Self-Employed

Unlike most tax software that requires an extra fee for expert assistance, TaxSlayer Self-Employed includes professional support in its pricing.

Key Features:

- Expert tax advice included in the package

- Auto-fills data from previous tax returns

- Offers reminders for quarterly estimated tax payments

- Mobile-friendly for easy filing

Pros:

- Professional tax assistance included at no extra cost

- Helpful reminders for estimated tax payments

- Affordable compared to other software

Cons:

- No support for S-Corps or C-Corps

- No offline version available

If you want expert tax guidance without additional fees, TaxSlayer Self-Employed is an excellent option.

FreeTaxUSA

For businesses looking to minimize tax filing costs, FreeTaxUSA offers free federal filing with low-cost state filing.

Key Features:

- Free federal tax filing

- State filing available for just $14.99

- Audit support and unlimited amended returns available for an extra fee

- Imports past tax returns for easy filing

Pros:

- Completely free for federal filing

- Simple and straightforward platform

- Affordable state filing

Cons:

- No mobile app

- Lacks some advanced features of paid competitors

- Customer support is more limited

If you need a low-cost solution for federal tax filing, FreeTaxUSA is the best option.

What Can Business Tax Filing Software Do for You?

Business tax filing software helps simplify tax preparation by automating calculations, identifying deductions, and providing expert support when needed. Some key features include:

- Automatic Data Import: Saves time by pulling in W-2 and 1099 forms automatically.

- Industry-Specific Deductions: Helps you find deductions and tax credits relevant to your business.

- Audit Support: Many platforms offer free or paid audit assistance if the IRS reviews your return.

- Live Expert Help: Some software includes professional tax advice to guide you through complex tax situations.

How to Choose the Best Business Tax Filing Software

Not all business tax filing software is the same, so it’s important to consider your specific needs when choosing a platform. Here are some key factors to keep in mind:

- Cost: Tax software pricing varies, with some offering free federal filing and others charging higher fees for extra features. Consider your budget and whether additional features are worth the cost.

- Features: Look for software that includes the features you need, such as tax form imports, deduction searches, and audit support. Some platforms also offer bookkeeping integrations.

- Expert assistance: If you want access to professional tax help, check whether the software offers live support and whether it’s included in the base price or requires an upgrade.

- Customer service: Good customer support is essential if you run into issues. Some platforms offer phone, chat, or email support, while others may have limited options.

- Mobile accessibility: If you prefer to file taxes from your smartphone or tablet, choose a platform with a mobile app for easy access.

Alternatives to Business Tax Filing Software

If tax software isn’t the right fit for you, consider these alternatives:

- Hiring a tax professional: A certified tax professional can handle your business tax filing for you, reducing stress and ensuring accuracy. While more expensive than software, this option is great for complex tax situations.

- DIY tax filing: If you have a strong understanding of tax laws and bookkeeping, you can manually file your business taxes. This approach saves money but requires a lot of time and attention to detail.

Final Thoughts

The best business tax filing software depends on your needs and budget.

- H&R Block is the best overall choice for its comprehensive service.

- TurboTax Premium is great for audit protection.

- TaxAct Self-Employed is perfect for bundling business and personal returns.

- TaxSlayer Self-Employed includes expert tax assistance at no extra cost.

- FreeTaxUSA is ideal for those looking for free federal tax filing.

By choosing the right tax software, you can make tax season less stressful and focus on running your business efficiently.